Watch live

Monday to Friday

In Case You Missed It

This podcast series is exposing the truth behind Ontario's Greenbelt controversy

Celebrate with BT

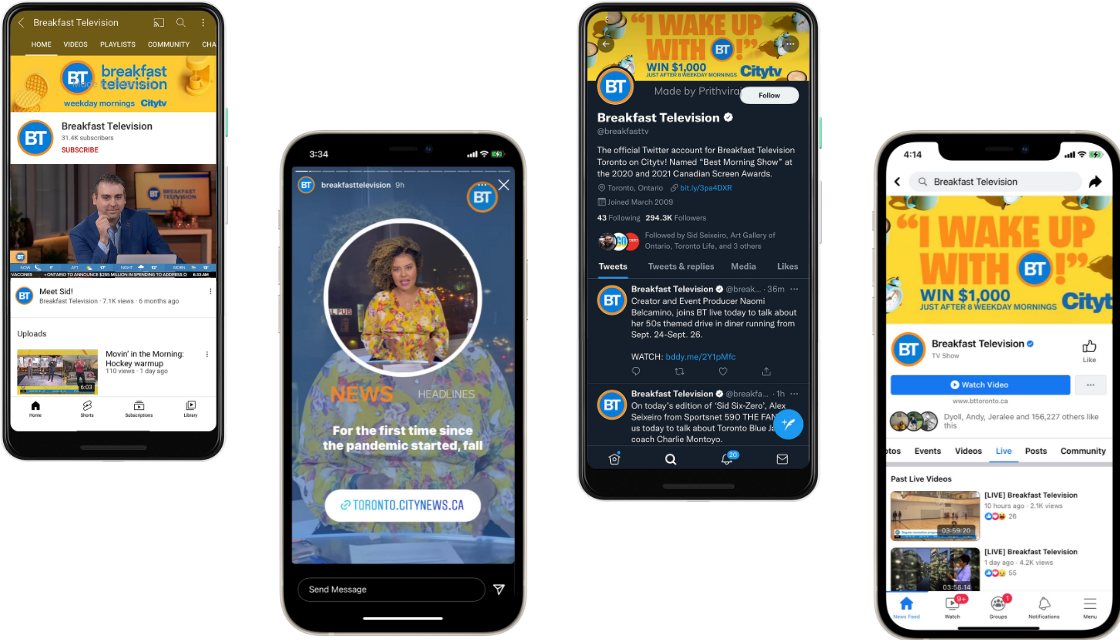

Connect with @breakfasttelevision

live, weekday mornings

Subscribe or follow to watch live weekday mornings on Citytv, YouTube and Facebook. Connect with us on Instagram and Twitter for more news and entertainment